The use of cutting-edge technology for project design, client relations, management and marketing has become far more prevalent throughout the kitchen and bath design community since the onset of COVID-19 and its resultant impact on showroom protocols, client access and other business operations.

Tied to this overarching trend, kitchen and bath design professionals are apparently utilizing – and spending more on – an ever-broadening array of technological tools, as companies attempt to upgrade websites, conduct online meetings, enhance digital presentations, offer virtual showroom tours, provide internet purchasing options and implement virtual and/or augmented reality. At the same time, dealers and designers report they are facing a handful of challenges in implementing the seemingly unending flood of high-tech tools becoming available.

Those are among the key findings of a nationwide survey conducted on behalf of Kitchen & Bath Design News by its exclusive research partner, the Research Institute for Cooking and Kitchen Intelligence (RICKI). The online survey, conducted in July, involved a representative sampling of kitchen/bath dealers and designers, including those at firms that maintain a showroom as well as those who operate independently.

According to the survey’s findings, eight in 10 dealers and designers polled currently use both a smart phone and a company website as the primary technology tools for their businesses. Design software, laptops, social media and Cloud-based storage are utilized by more than half the survey respondents. Other commonly used technology tools include business/design apps, online advertising, business management/ordering software and contact/email management software (see Figure 1, above).

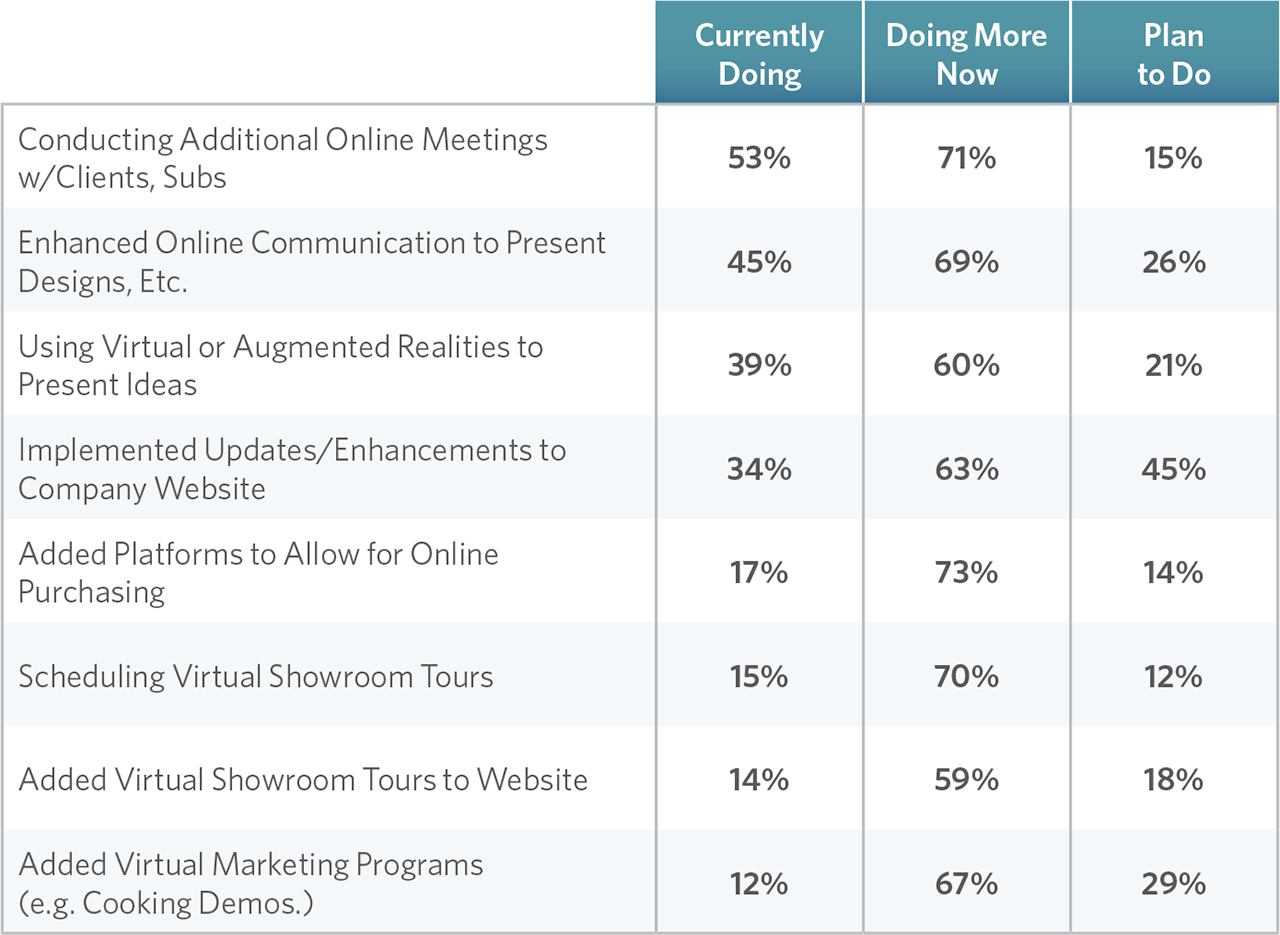

The KBDN survey also revealed that recipients’ top three technology-related activities revolve around conducting online meetings with clients and/or subcontractors, enhancing online communication to present designs or proposals, and using virtual and/or augmented reality to demonstrate design possibilities to clients. Moreover, a vast majority (between 59%-73%) of those surveyed say they are doing more of those things compared to pre-COVID – particularly when it comes to handling project drawings or designs – while a significant number say they anticipate adding those, along with other, technological capabilities in the future (see Figure 2).

On average, surveyed designers and dealers report that they currently spend about 8% of their annual expense budget on various forms of technology, with 38% reporting that they are now spending more than they were prior to the global pandemic, and 56% saying they’re spending about the same. In contrast, only about 6% say they’re spending either “somewhat” or “much” less than prior to COVID-19 (see Figure 3).

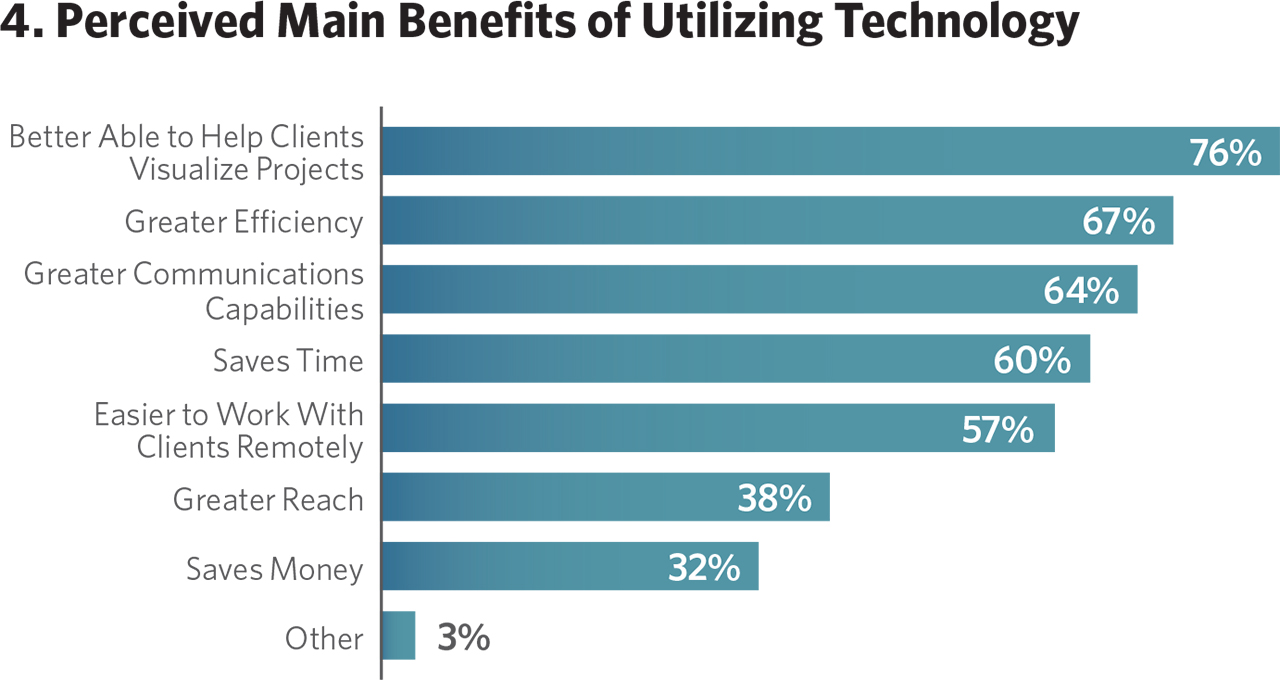

Designers and dealers also told KBDN that the primary benefit they accrue from technology is to assist clients in visualizing their kitchen and bath projects, followed by the ability to achieve greater efficiency and the ability to more effectively communicate. Others say it saves time and allows them to work more effectively with remote clients (see Figure 4).

MARKETING & OTHER ACTIVITIES

When it comes to utilizing technology tools to market their business, surveyed designers and dealers said they primarily utilize their company’s website (82%), along with social media posts (53%). More than half of the surveyed design pros say they are now using LinkedIn ads, text/mobile ads and blogs/forums more than they were a year ago, though all of those tools are used relatively infrequently.

Almost half of the surveyed designers and dealers say they plan to make updates or enhancements to their websites in the short-term future, with one in three updating their website at least quarterly.

Just over half of the designers and dealers surveyed by KBDN say they are heavily involved in digital marketing. On the flip side, one in six report that they don’t use digital marketing at all. The primary barriers for integrating digital tools into their marketing activities are a sentiment that their business is performing well enough without it (49%) and the perceived time that it takes to implement (33%).

Among other key survey findings:

Design professionals generally believe that technology is of far higher importance to clients in terms of the business services that dealers and designers can provide compared to having technology incorporated into the kitchen and bath products that are used in their projects. Surveyed design pros feel that, on average, only about a quarter of their clients show interest in kitchen and bath products utilizing new types of technology such as automation and connectivity. If a client does express interest in product technology, surveyed designers and dealers say those clients most likely request built-in charging stations (75%), new lighting applications (55%) and connected appliances (44%).

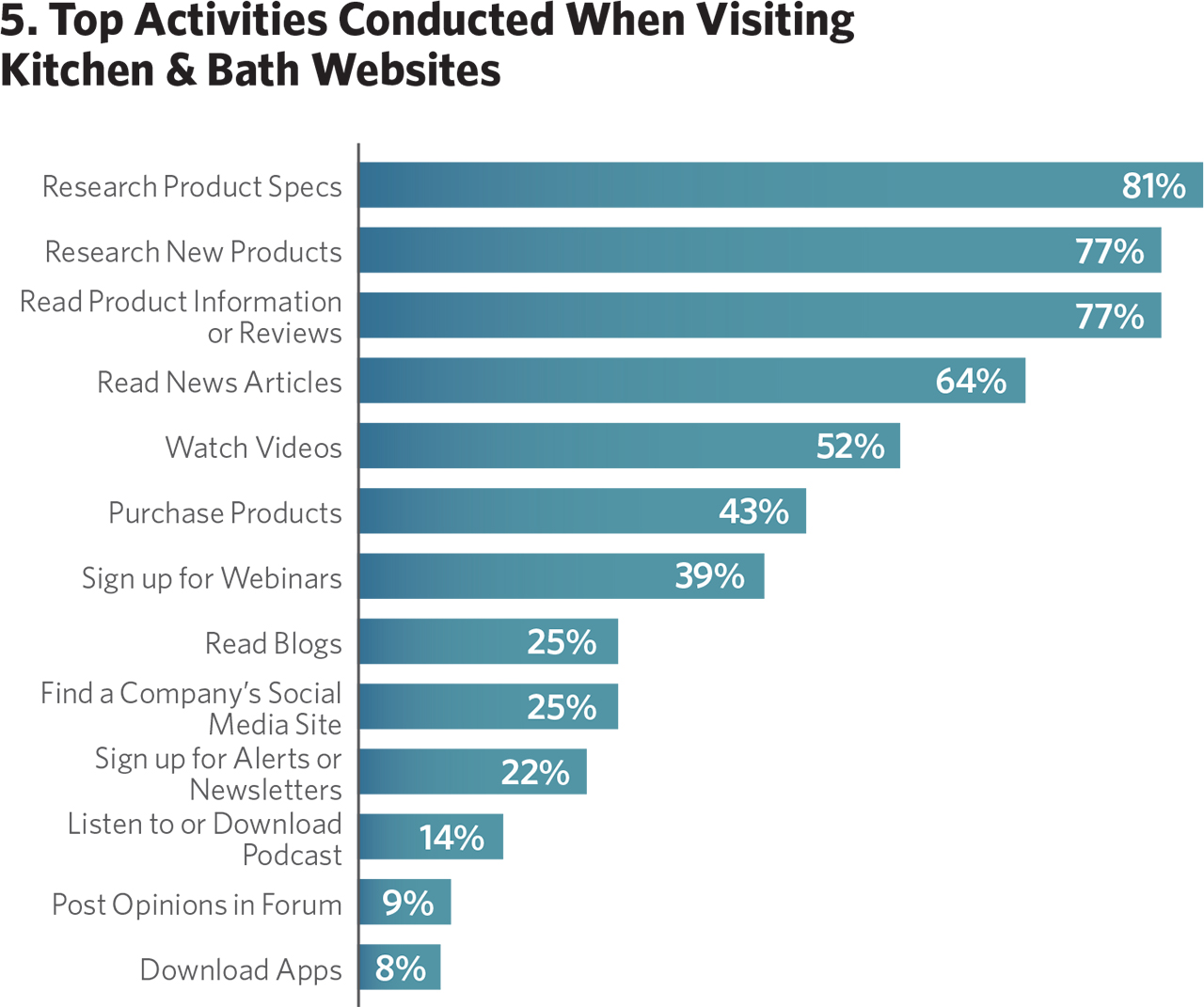

About seven in 10 designers and dealers say they are visiting kitchen or bath industry-related websites more than once a week, with more than two in five visiting those websites daily or several times a week. The top activities performed when visiting websites are accessing product specs, researching new products, accessing product information or reviews and reading news articles (see Figure 5).

Surveyed designers and dealers use an average of three mobile apps for business purposes, and almost a third of those polled say they are currently using apps for business more compared to a year ago, prior to COVID. The apps used most are Facebook (21% of those surveyed), Instagram (15%), Houzz (13%) and Zoom (10%). ▪