Disruptions in the global supply chain, wrought largely by the lingering impact of COVID-19 and robust demand, continue to be a significant industry-wide challenge. Lead times for both domestic- and foreign-sourced products and materials are reportedly stretching for weeks, if not months, while forcing kitchen and bath design professionals to employ an array of tactics aimed at mitigating the impact of delivery delays, inflation-fueled price pressures and consumer uncertainty.

Those are among the key findings of a nationwide survey conducted by Kitchen & Bath Design News in conjunction with its exclusive research partner, the Research Institute for Kitchen Intelligence (RICKI). The online survey, fielded early in 2022, involved more than 350 kitchen/bath dealers, designers, remodelers and other specifiers in markets across the U.S.

KBDN’s survey results, which mirror those of trade organizations like the National Kitchen & Bath Association and the National Association of Home Builders, found that record-high product backlogs, a challenge for nearly two years, continue to remain vexing even as the pandemic wanes – lengthening the time before work can begin on kitchen/bath remodels, while increasing project costs, squeezing profit margins, expanding construction cycles, and causing skittish customers to temporarily postpone, and even cancel, remodeling commitments until market conditions settle.

Equally evident is the pervasive belief that global logistical problems, skilled labor shortages and pricing pressures are not likely to dissipate any time soon – and, indeed, may even worsen in the months ahead.

SURVEY FINDINGS

Nearly every kitchen and bath design professional (97%) surveyed by KBDN reported experiencing some degree of disruption to the product supply chain, with nearly nine in 10 (86%) reporting “moderate” to “major” disruptions, even as business remains generally positive, and expectations remain high. In contrast, only 11% of those surveyed said that delays are “minor,” and even fewer (3%) report no disruptions at all (see Figure 1).

Nearly half of those surveyed (49%) report that delays in products/materials shipments are most often lasting from three to six months, with the majority (43%) of the delays three months in duration. By comparison, some 29% of dealers and designers polled report shipment delays averaging about two months, while nearly four in 10 report product delays lasting more than six months, and only 8% say that delays are less than a month in duration (see Figure 2).

Roughly half of the kitchen and bath professionals surveyed say they expect supply chain disruptions to continue at the same rate as they are now. One in four say they believe that the supply chain issues will improve, while one in five expect conditions to worsen.

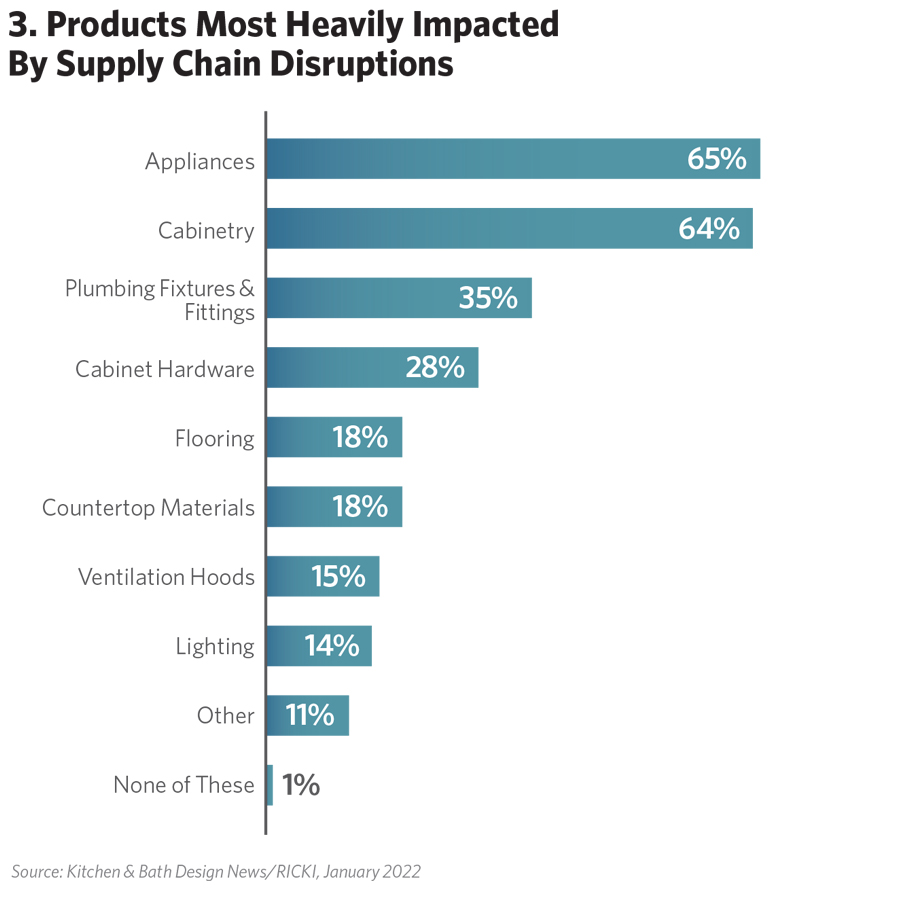

Major home appliances – particularly refrigerators and cooking appliances – along with cabinetry have been the product categories most heavily impacted by supply chain issues, twice that of any other category of kitchen and bath product, surveyed design professionals report.

Also impacted, among other products, have been plumbing fixtures and fittings, cabinet hardware, flooring and countertop materials like granite and ceramic tile, KBDN survey respondents say (see Figure 3).

In a similar vein, 67% of those surveyed report that, in terms of raw materials, lumber has been impacted most dramatically by supply chain issues, twice that of other materials such as steel, aluminum, plastics, foam, gypsum, stone, concrete and copper.

CHALLENGES VARY

But supply chain snafus have resulted in more than simply delays in product and material shipments, kitchen and bath design professionals tell KBDN.

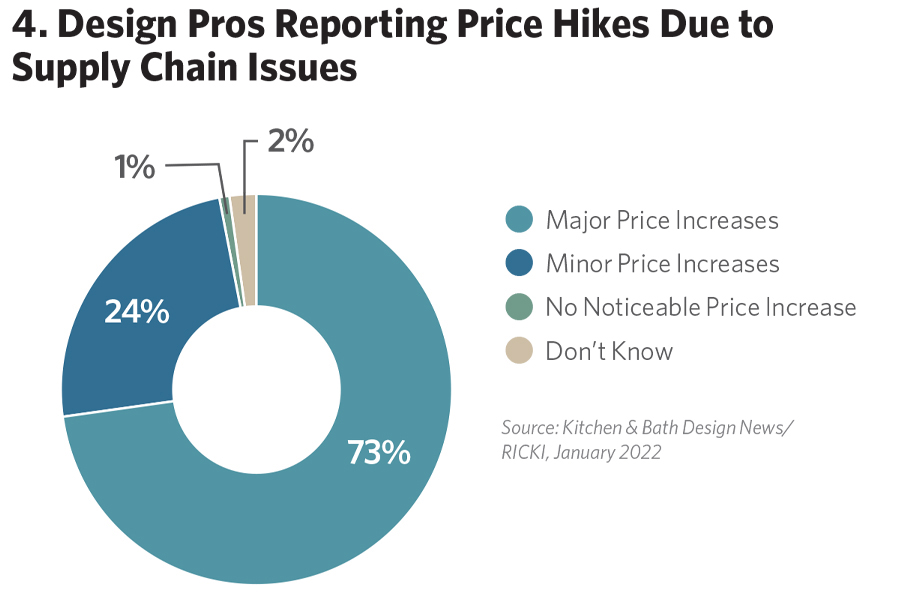

For example, nearly three in four (73%) of those surveyed report that supply chain issues have resulted in “major” price increases for products, while another 24% say that price increases, while palpable, have been “minor.” In contrast, only 1% of survey respondents report they’ve witnessed no noticeable product price increases due to the delays (see Figure 4).

Equally impactful has been the effect of shipment delays on profit margins. For example, more than half (52%) of surveyed kitchen and bath professionals report that product/material price increases, while generally being passed along to customers, have decreased their profit margins. In contrast, only 17% of respondents say they’ve experienced either a significant or a minor positive bump in margins.

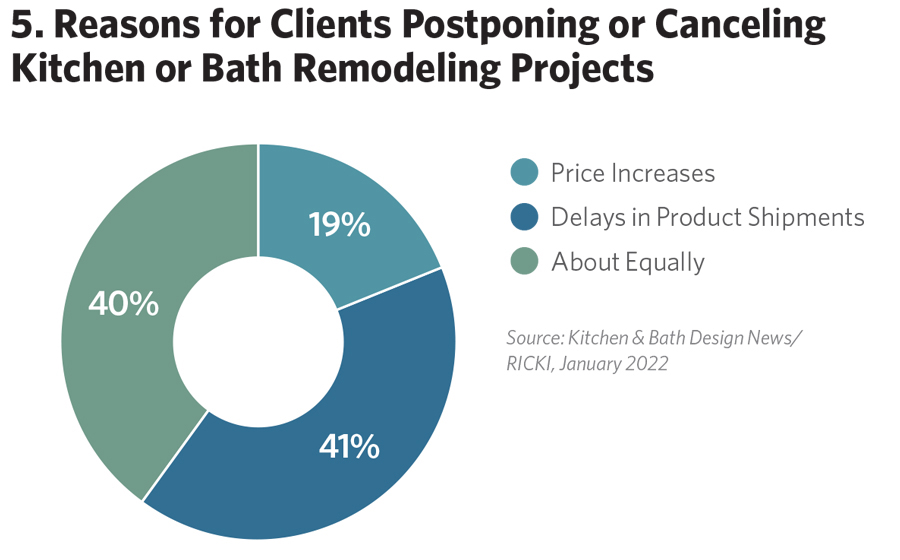

Lastly, more than half (55%) of current kitchen and bath customers are postponing or canceling projects as the result of either shipment delays or price increases, according to surveyed design pros. The reasons for the postponements or cancelations, survey respondents report, are about equally tied to price increases or shipment delays (see Figure 5). ▪

Design Pros Employing Array of Tactics to Mitigate Disruptions

CHICAGO — Initially flummoxed by ongoing disruptions in shipments of products and raw materials, kitchen and bath design pros say they have implemented an array of common-sense tactics to mitigate the impact of product scarcities, increased construction timelines and skittish customers.

According to a nationwide survey conducted by KBDN in conjunction with its exclusive research partner, RICKI, industry pros are increasingly developing relationships with lesser-known brands and local suppliers, often specifying brands they never previously considered while guiding customers to alternative products that are available to fit time frames and budgets.

More than six in 10 surveyed design pros report that they have changed at least some suppliers due to supply chain disruptions. Others note that they’ve altered their planning, ordering and scheduling procedures. Still others are reportedly stocking storage facilities with inventory, buying in bulk whenever possible, checking the availability of products even as they design, adding additional upfront time to projects and focusing on fewer product lines in order to streamline production.

Communication, they say, is also more critical than ever, with all parties involved in the project being fully up to speed regarding the severity of supply chain disruptions and setting realistic expectations.

Those findings are echoed by other surveys.

According to the National Kitchen & Bath Association, members have been increasingly turning to U.S.-based suppliers, as well as to local cabinet shops and skilled local artisans, rather than relying strictly on major international brands, although some smaller overseas suppliers – particularly high-end, niche brands with warehousing and distribution in the U.S. – often have enough available inventory to fill a need in a timely fashion.

Lengthy appliance delays have led many designers to specify and order products well before design plans are finalized, according to the NKBA, which noted that remodeling clients, in some cases, aren’t discarding old appliances, or are utilizing temporary appliances, until new ones are delivered.

“We try to get customers to purchase items that have a long lead time as soon as the contract is signed,” one designer told KBDN. “We’ve also altered our business model and order products before designs are even completed. In addition, we leave variable costs open so that we don’t have to cover increased product costs, and we tell our customers up front to expect delays.”

“Our strategy now is to plan, plan and plan,” another designer said. “We also take more time defining the budget and working on the schedule, so we order products early and start construction later, extending the waiting period between contract signing and the start of construction. In addition, we order and stockpile materials as soon as a project is committed.”

Other dealer/designer comments were as follows:

- “I have found new vendors and added product lines to help ease lead times. Our company has been reaching out to other companies to investigate options for getting products sooner. We’re also being realistic with clients regarding the delays we’ve been experiencing.”

- “Finalizing orders as quickly as possible after decisions are made, ordering and receiving products before construction begins, and managing client expectations with complete transparency have been keys for us.”

- “We’ve been trying to source locally-made products and in-stock items, and we’re in constant contact with suppliers about what’s readily available so we can have ‘real’ data regarding lead times. We’re also trying to find out in advance what products are available immediately and are steering clients toward those items.”

- “Homeowners must be prepared for longer wait times and increased prices. Above all else, they must remain flexible, because nearly every single phase of the supply chain has been impacted somewhere along the way by COVID-19.” ▪

Industry Termed ‘Nimble & Optimistic’ Despite Supply Chain, Other Challenges

HACKETTSTOWN, NJ — The kitchen and bath industry ended 2021 on a positive note, remaining “nimble, creative and optimistic” in the face of continuing supply chain disruptions, double-digit price increases and other challenges, the National Kitchen & Bath Association reported last month.

The NKBA issued its comments in conjunction with the release of its final “Kitchen & Bath Market Index” for 2021.

“We’re extremely encouraged by the latest KBMI results, as they confirm that the industry remains optimistic about its future, with the sector remaining nimble and creative in order to be successful in the face of continuing challenges,” said Bill Darcy, chief executive officer for the Hackettstown, NJ-based NKBA.

“While we’re keeping our eye on things such as ongoing supply chain issues and inflation, the fundamentals for the industry remain strong, including continued consumer demand with strong home values and equity levels,” Darcy observed.

According to the NKBA, the residential remodeling industry “has been the beneficiary of a seller’s home market, with homeowners leveraging their home’s market value to renovate spaces within their home to both increase value as well as livability and flexibility.”

In Q4 2021, all kitchen and bath segments reported double-digit year-over-year sales growth, as well as a solid quarter-over-quarter performance, with an increase of 8.1% in total spending, the NKBA reported. While challenges persist, “some of these may be helping the industry see long-term growth by spreading out projects into 2022,” the association added, noting that surveyed industry professionals project 13.1% annual growth this year, even in the face of supply chain disruptions, skilled-labor shortages and inflation.

“Virtually every sector of the economy has been affected by the ongoing supply chain, material and labor issues, with the kitchen and bath industry being no exception,” Darcy said. “However, the kitchen and bath industry continues to be resilient in the face of this adversity, setting itself up for another year of growth,” he added. ▪