2023 is shaping up to be far more of a bumpy, unsettled ride than that of 2022, with kitchen and bath design firms being forced to navigate a plethora of challenges, including an anticipated housing and remodeling slowdown, higher costs for products and raw materials, lingering supply chain disruptions, labor availability issues and widespread consumer uncertainty.

That is the consensus of a nationwide survey of nearly 400 kitchen and bath dealers, remodelers and designers in businesses across the U.S. Results of the online survey, conducted late last year by Kitchen & Bath Design News, mirrored those of similar industry polls, as well as trade association forecasts for new construction, home sales and residential remodeling.

Asked how concerned they are that current market conditions will impact business operations and profits in 2023, roughly 61% of surveyed firms told KBDN that they’re either “extremely concerned” (27%) or “very concerned” (34%). Another 34% reported that they’re “somewhat concerned.” In contrast, less than 5% said that they’re either “not very concerned” or “not at all concerned” (see Figure 1).

“2023 will be a challenging year for the kitchen and bath industry,” one business owner observed. “High interest rates will result in a new-construction slowdown, as homebuyers decide to wait until rates decline. Remodeling will slow down if buyers finance their projects.”

“The rapid growth in early 2022 has slowed significantly,” another survey respondent said. “We’re focused now on profitable sales and modest growth, while streamlining in all areas – including people, processes and all expenditures. Our weekly new customer initial contact calls have dropped off by 75%.”

“I believe we will start to catch up on the COVID-related backlog of projects and will start to slow down on new projects as the economy slows,” still another survey respondent commented. “This will result in slower growth after a banner year in 2022.”

“I believe that consumers will be cautious in their spending in 2023 and will look for value. I further believe that a softening in consumer traffic will create stiffer competition, and that consumers will migrate to the more-reliable, experienced suppliers for their needs.”

SLOWER GROWTH

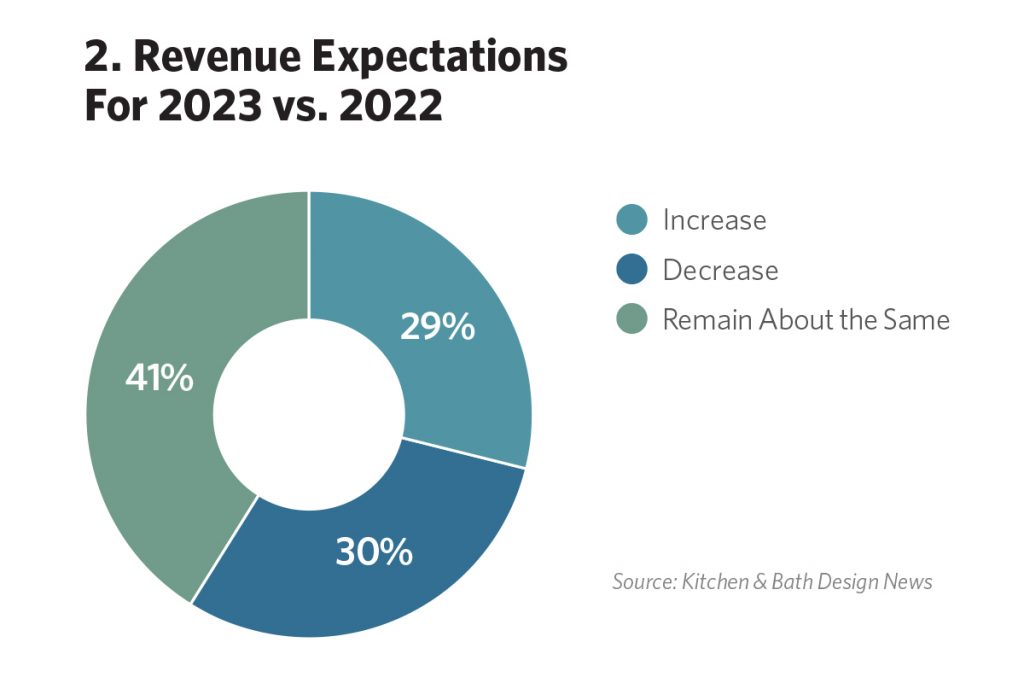

This widespread feeling of uncertainty and concern is reflected in 2023 revenue projections. For example, while only 29% of those surveyed said they expect their company’s revenue to increase in 2023 compared to 2022, a significant percentage (30.2%) said they expect 2023 revenue to decline, while the majority (40.7%) anticipate that 2023 revenue will remain no better than about the same this year as in 2022 (see Figure 2).

Revenue gains are anticipated for both new and remodeled kitchens and baths, although dealers and designers are far more bullish about revenue growth from kitchens (62.9%) than they are from baths (25.6%). Interestingly, roughly 11.5% see 2023 growth deriving from other-room projects such as home offices, wine bars and laundry areas – no surprise given the impact of COVID-19 on remote work and other living arrangements.

But while revenue may increase for some firms in 2023, the rate of growth has reportedly tapered off and is expected to cool even more in the months ahead, as inflation scythes through the economy, housing affordability remains at historically low levels and product/labor availability continues to hamstring design and remodeling firms.

Specifically, among those firms expecting 2023 revenue growth, roughly 66% believe the anticipated increase will be at a slower pace than it was in 2022. By comparison, only about 34% believe the anticipated revenue increase this year will be at the same pace as in 2022.

Design firms are evenly split over the projected impact of 2023 business conditions on profit margins, with 25.7% reporting they expect 2023 margins to increase, the same number anticipating a decline, and the balance (49%) saying they expect margins to remain about the same this year as in 2022 (see Figure 3).

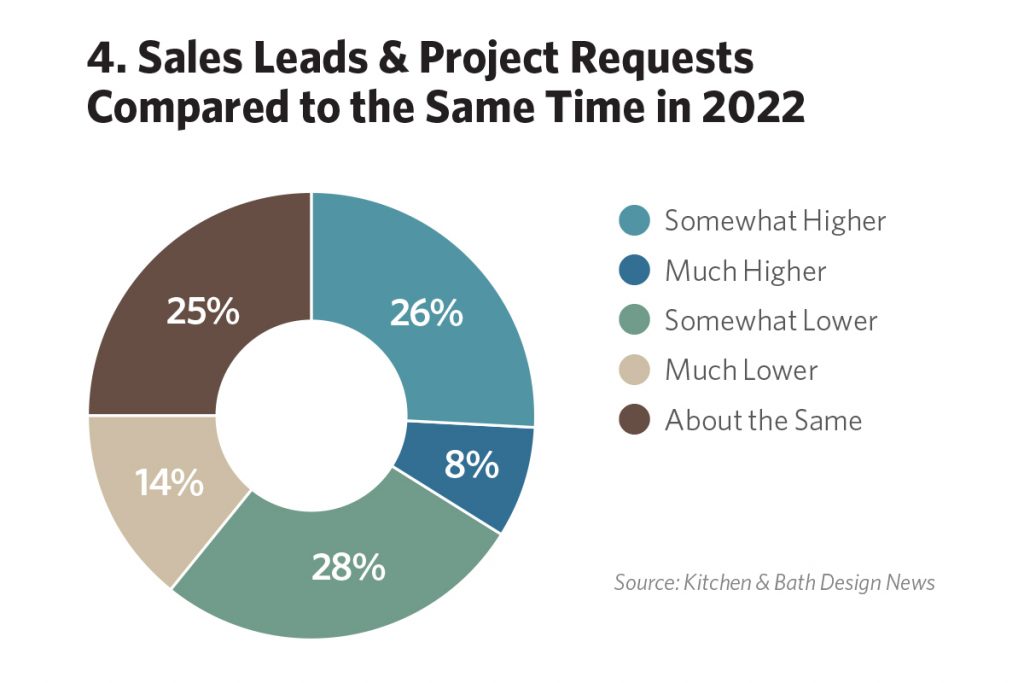

Dealers and designers also report a modest decline in sales leads and project requests compared to the same time a year ago. Specifically, about 41% of survey participants report that their current sales leads are either “somewhat lower” or “much lower” than they were at the same time a year ago, while roughly 34% report that current sales leads are either “somewhat higher” or “much higher,” and about 25% say their leads are about the same as a year ago, when a confluence of COVID-related demand, growth in savings, equity appreciation and larger, more-multi-functional homes were a focus of consumer spending (see Figure 4).

Other KBDN survey findings include the following:

Price has apparently become more of an issue for kitchen and bath consumers, with 60% of survey respondents reporting that pricing is more important now than it was a year ago. In contrast, only 4.7% of survey respondents said that pricing is less important now, while 35.3% said it’s similar in importance to one year ago.

“There are fewer consumers willing to stretch their budget and more who are anxious to find ways to save money without compromising design and function,” one designer firm owner observed, adding that “it’s very challenging.”

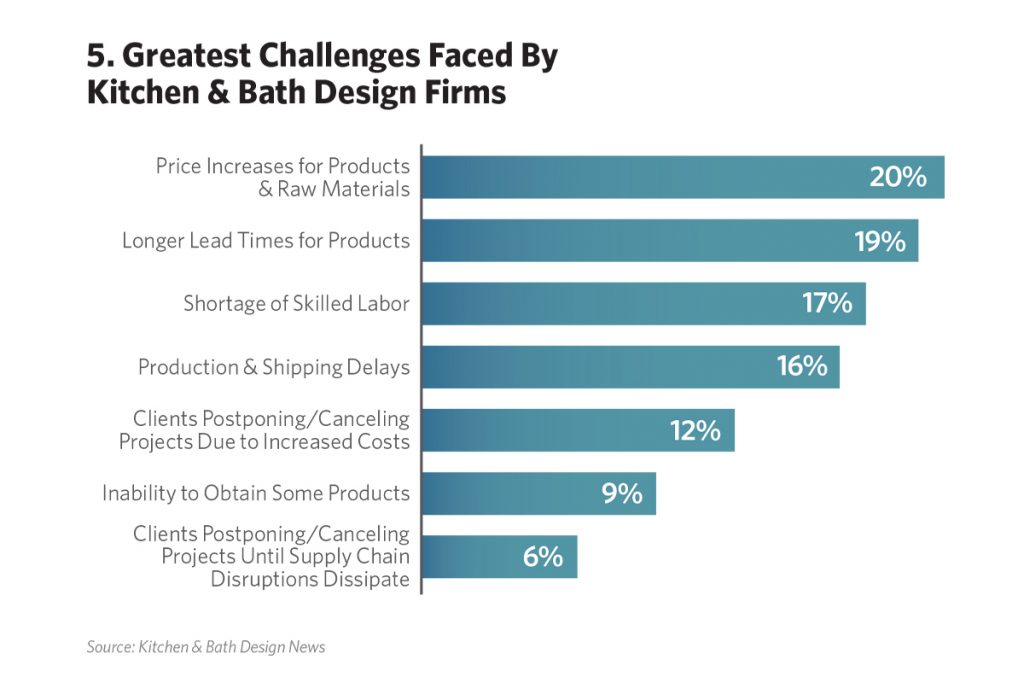

Price increases for products and raw materials, longer lead times for products, and a shortage of skilled labor remain the three greatest challenges that design firms face as 2023 gets underway, survey respondents said (see Figure 5).

“It’s very difficult to find the skilled labor we’re accustomed to having,” a business owner lamented. “Products are arriving damaged, and we’re constantly waiting for replacements and then having to send our crews back out to fix those issues. And because our install lead time is so far out, some suppliers don’t want to replace (product) because it’s been in our warehouse for months, waiting on the start date. There are constant headaches.”

“There are so many hurdles,” another owner reported. “Supplies are not coming on time or are arriving damaged. The unavailability of contractors is huge. Many are working on new builds or are just so busy they won’t make time for other projects. It’s quite frustrating. I’m trying to focus more on design that I can control the timeline and materials for.”

Increases in client requests are being reported for universal design for aging-in-place elements (19.3%); smart/connected appliances in the kitchen (12.0%); sustainable/environmentally friendly products and materials (11.1%); outdoor kitchens (10%); ventilation products (8%); hands-free products (6.9%); home security (6.4%); wellness products (6.2%); anti-microbial materials (3.8%), and smart/connected fixtures in the bath (4.0%).

COPING WITH CHALLENGES

Design firms tell KBDN that they are deploying a wide range of tactics to cope with anticipated market challenges in 2023.

“Our plans are to operate with a very conservative mindset in anticipation of a continued slowdown,” one business owner reported. “We will be adding more products to have a wider range of price options for our clients.”

“We’ve cut out all unnecessary spending and are trying to build a war chest to weather the upcoming storm,” another owner told KBDN. “Sales down and expenses up is not the way I wanted to start the new year.”

“I’m considering holding off on raises as I’ve noticed designer sales are down and I’m working harder to close more business,” a third survey participant said. “Instead, I’m changing showroom hours to allow employees to work 35 hours instead of 40 if they want.”

Other firms report an increased use of social media and other marketing initiatives to drive sales leads, adding salespeople to drum up business, stepping up recruitment efforts for installation crews, and adjusting project schedules to allow for delays in product deliveries.

“I’m just watching everything very closely,” one business owner said. “It’s very difficult to get things completed because of all the interruptions. Very frustrating!”

“It’s still too early to tell, but we’re keeping a watchful eye on our backlog as well as on client maintenance,” another survey respondent said. “There are some things that are not in our control. We want to address items that we can, and then let things happen as they will.”

“We’re going to hold tight on our business operations going into 2023,” yet another owner told KBDN. “Having been in the industry for more than 19 years, and a business owner for the last 12 years, we’ve seen these cycles of uncertainty, whether it was for economic or political reasons. It’s just best to remain cautious and fluid to whatever circumstances we may be faced with.” ▪